We believe the classic quote from Benjamin Franklin – “A failure to plan is a plan to fail.” Most clients will, at some point, make the transition from working to retirement.

In that process, most have the same set of questions:

How much money do I need to retire?

How much can I afford to live on?

How long will my money last?

At what age can I afford to retire?

At what age should I take Social Security?

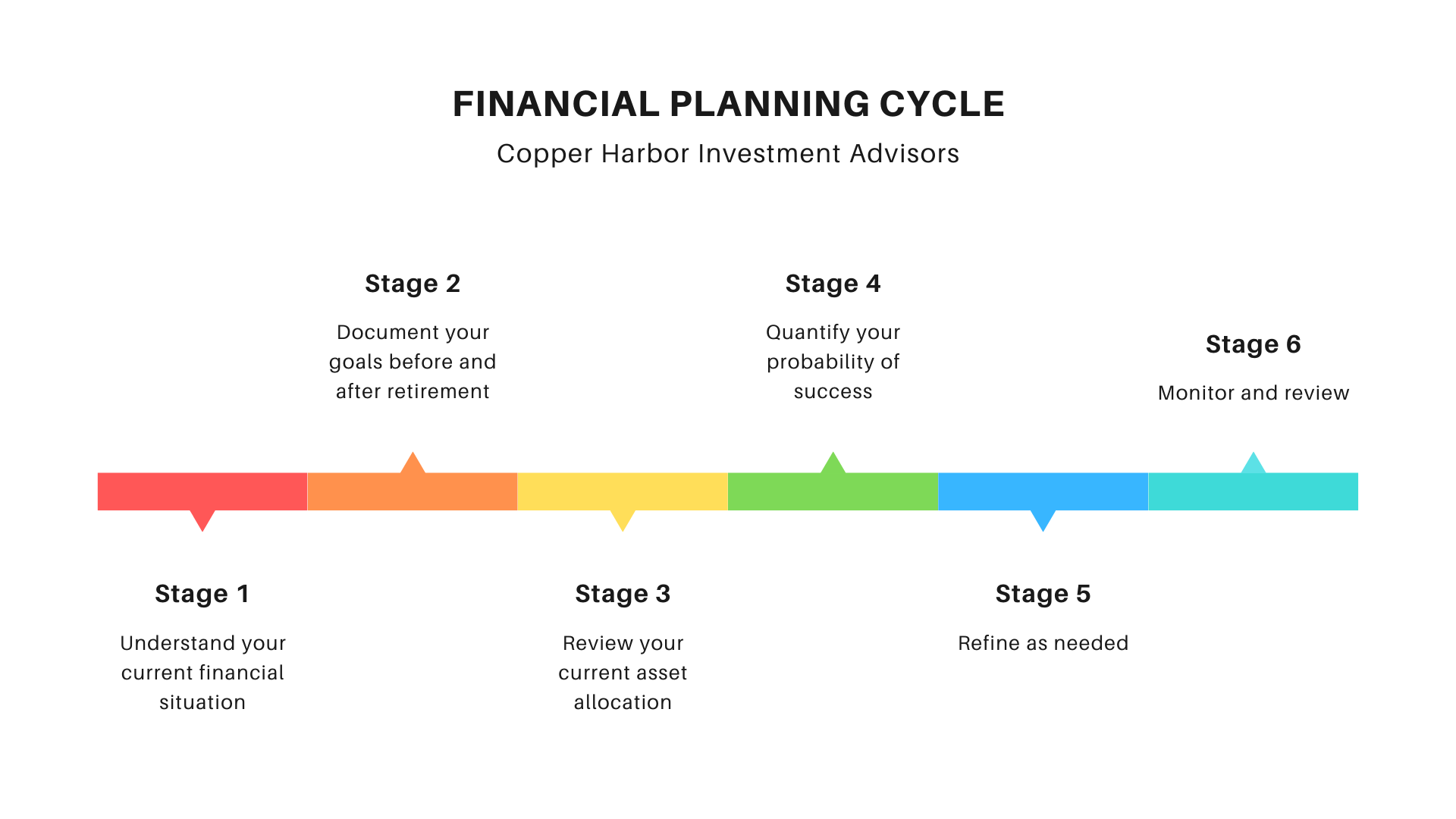

With our planning process, we help alleviate the stress associated with planning for retirement and help clients answer those critical questions.